In the world of finance and accounting, it’s important to grasp the distinctions between various financial terms to maintain accurate records and make informed business decisions.

Two terms that often cause confusion are accounts receivable and accounts payable.

Continue reading to learn their differences, similarities and use examples.

What Are The Differences?

Here is how you can distinguish accounts receivable and payable.

Accounts Receivable

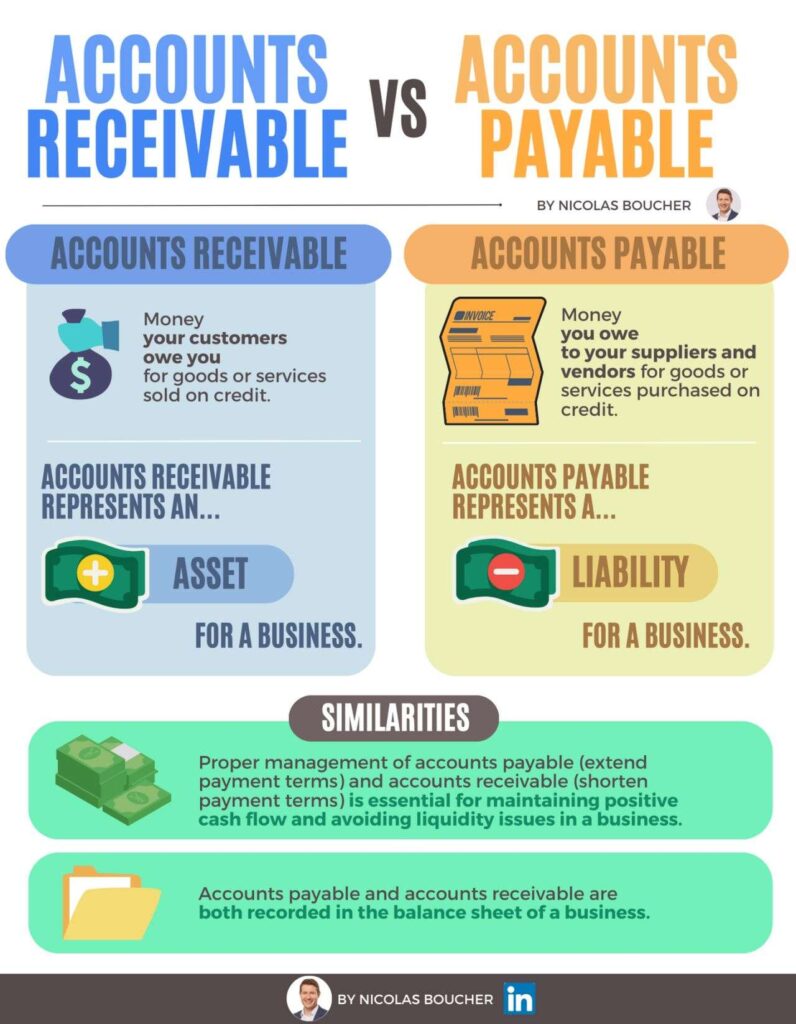

Accounts receivable represents the money owed to a business by its customers or clients for goods or services provided on credit.

When a company sells its products or services with a payment term, such as 30 days, it creates an accounts receivable.

It acts as an asset for the company since it represents the amount receivable in the future.

For example:

If a customer purchases $1,000 worth of goods with a payment term of 30 days, the company records it as accounts receivable.

Accounts Payable

Accounts payable refers to the money that a business owes to its suppliers, vendors, or creditors for goods or services purchased on credit.

When a company buys goods or receives services with a payment term, it incurs an account payable until it is settled.

For instance:

If a company purchases $2,000 worth of raw materials with a payment term of 60 days, it records it as accounts payable until the payment is made.

What Are The Similarities?

While accounts receivable and accounts payable are distinct concepts, they share some similarities that are vital for effective financial management:

- Managing Cash Flow: Properly managing both accounts receivable and accounts payable is crucial for maintaining positive cash flow. By collecting accounts receivable promptly and strategically managing accounts payable to optimize payment terms, businesses can optimize their cash flow and avoid liquidity issues.

- Credit Transactions: Both accounts receivable and accounts payable arising from credit transactions. Companies extend credit to customers when they sell goods or services on credit, resulting in accounts receivable. Similarly, companies receive credit from suppliers or vendors when they purchase goods or services on credit, leading to accounts payable.

- Recording and Tracking: Both accounts receivable and accounts payable require accurate recording and tracking. Businesses need to maintain proper documentation and records of transactions to ensure timely payments from customers and manage their outstanding liabilities to suppliers.

Real-Time Example of Accounts Receivable and Payable

Let’s consider a scenario where a manufacturing company purchases raw materials from a supplier and sells finished products to customers.

When the company receives the raw materials, it records the purchase as accounts payable until the payment is made.

Meanwhile, when the company sells the finished products to customers on credit, it records the sale as accounts receivable until the customers make the payment.

By managing them properly, the company can maintain a healthy cash flow and optimize its working capital.

The Final Verdict

Accounts receivable and accounts payable are integral components of a company’s financial management.

Understanding the key differences between them is crucial for accurate record-keeping and making informed financial decisions.

Accounts receivable represents the money owed to a business by its customers.

On the other hand, accounts payable represent the money a business owes to its suppliers.

By managing both aspects effectively, businesses can maintain positive cash flow, strengthen relationships with stakeholders, and ensure their financial stability.

Take your accounting to the next level with ChatGPT! Choose this practical guide to learn the basics. Furthermore, Check this page if you want to bring your team into a position to leverage AI for their work.

Key Takeaways

- Accounts receivable refers to money owed to a business by its customers, while accounts payable refers to money owed by a business to its suppliers.

- Accounts receivable represents an asset for the company, while accounts payable represent a liability.

- Properly managing both accounts receivable and accounts payable is essential for maintaining positive cash flow.

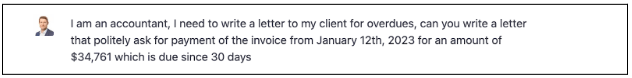

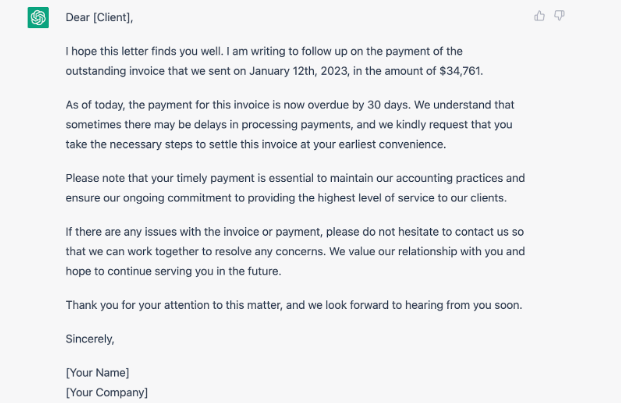

- Effective accounts receivable management involves timely invoicing, tracking payments, and addressing overdue accounts.

- Efficient accounts payable management includes negotiating favorable payment terms, making timely payments, and fostering strong relationships with suppliers.

FAQ

1. What is AutoGPT?

- AutoGPT is an advanced natural language processing (NLP) tool based on the GPT architecture. It’s an AI-powered language model that generates human-like text and can be fine-tuned for specific tasks like summarization, translation, or question-answering.

2. How can businesses use AutoGPT?

- Businesses can use AutoGPT to automate tasks like generating lists (e.g., product or customer lists), drafting public tender documents, producing macroeconomic reports, staying updated on regulations, conducting market research, and more.

3. How does AutoGPT help with market research?

- AutoGPT can generate surveys or questionnaires for market research purposes, helping businesses gather insights from customers and make informed decisions based on their preferences.

4. Can AutoGPT assist in finding subsidies?

Yes, AutoGPT can identify subsidies or grants based on industry or location, aiding businesses in discovering potential financial assistance opportunities.

5. How can AutoGPT aid in risk analysis?

AutoGPT can perform risk analysis by generating reports on potential risks or threats related to clients, suppliers, or other relevant entities.