Each role here has its own unique charm and challenges. Whether you dream of becoming a CFO, want to dive into FP&A, or are fascinated by Business Intelligence, this guide is for you.

We’ll break down the key responsibilities and must-have skills for each finance function. Also, you will see how you can progress in each!

Unique FP&A Program Offer

I’m sure you’ve come across many programs, but none have quite matched your ambitions.

Are you looking to transition into FP&A and want to demonstrate your commitment on your resume?

Or perhaps your boss has tasked you with building an FP&A process from scratch, and you’re unsure where to begin?

You can solve this easily and earn a globally recognized FP&A Certificate.

I am proud to present you with the FP&A certificate program in cooperation with one of the best universities in the world: Wharton!

My courses are also part of the program!

Enrollment is currently open, and I have a discount code for you (Use NICOLASBOUCHER to save $300 off your tuition).

Here are the details of the program:

- How long does it take to complete: 8 Weeks

- Time Commitment: 8 Hours per Week

- Format: Online Self Paced with Live Office Hours

- Tuition: $4,700 (after the $300 discount code)

- Certificate: Issued by Wharton and Wall Street Prep

- Closing Ceremony: Penn Club in NYC (Attend Live or Virtually)

- Faculty: Taught jointly by Wharton & Wall Street Prep

- Guest Speakers: Marcela Martin (Buzzfeed), Josette Leslie (Affinity.co), Debbie Sebastian (Eagle Family Foods Group), and more.

Join the program now, and you will advance in your FP&A career with this globally recognized Wharton certificate.

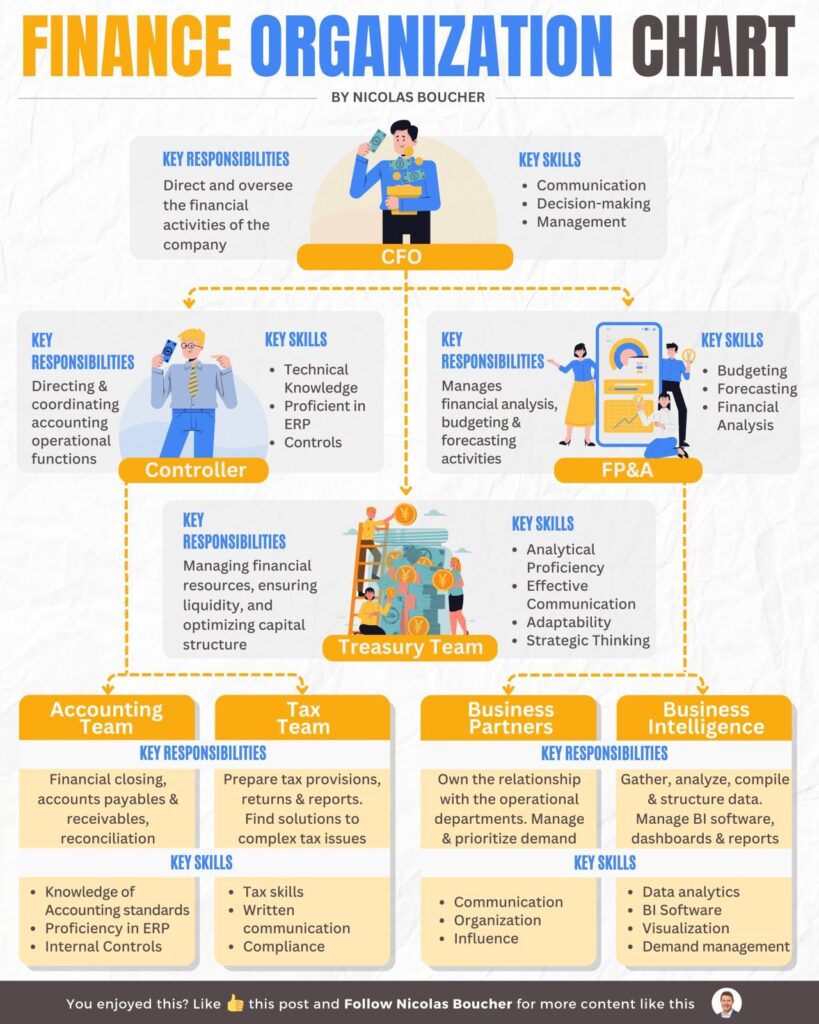

The Finance Function Explained

Here are the different finance roles and teams:

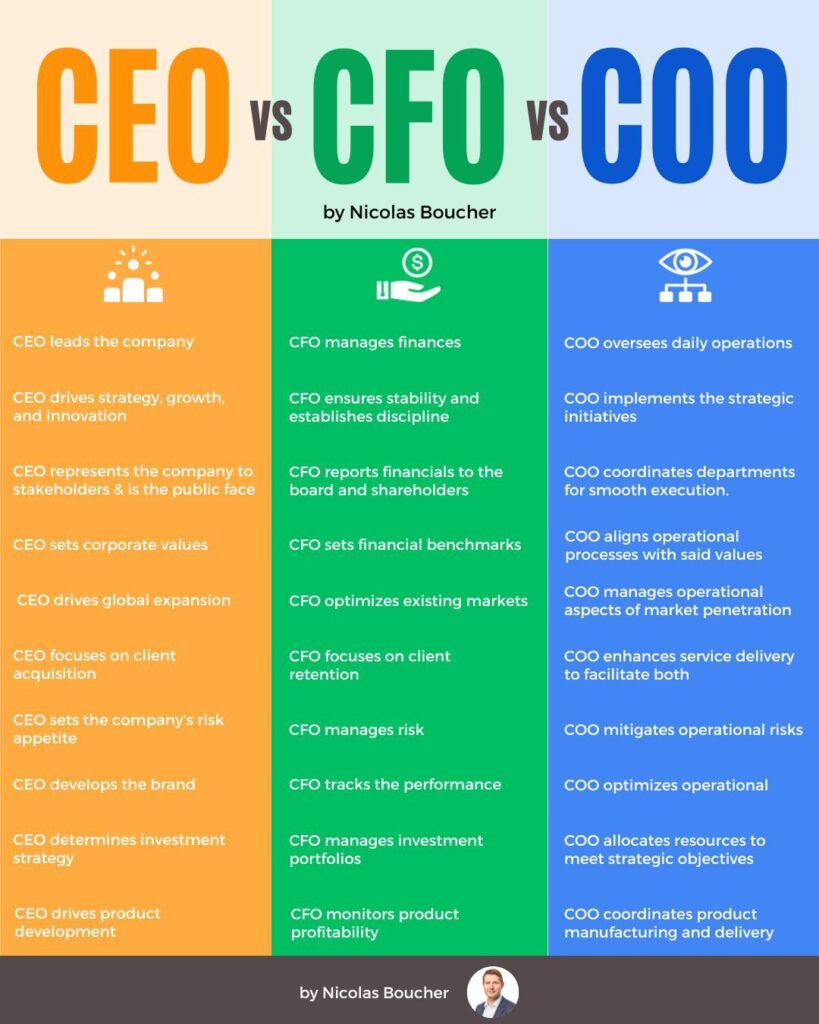

#1: Chief Financial Officer (CFO)

Key Responsibilities:

Direct and oversee the financial activities of the company.

Key Skills:

- Communication: Develop strong interpersonal skills to effectively communicate with stakeholders at all levels.

- Decision-making: Cultivate the ability to make strategic decisions under pressure.

- Management: Enhance leadership skills to manage finance teams and collaborate with other executives.

How to Progress:

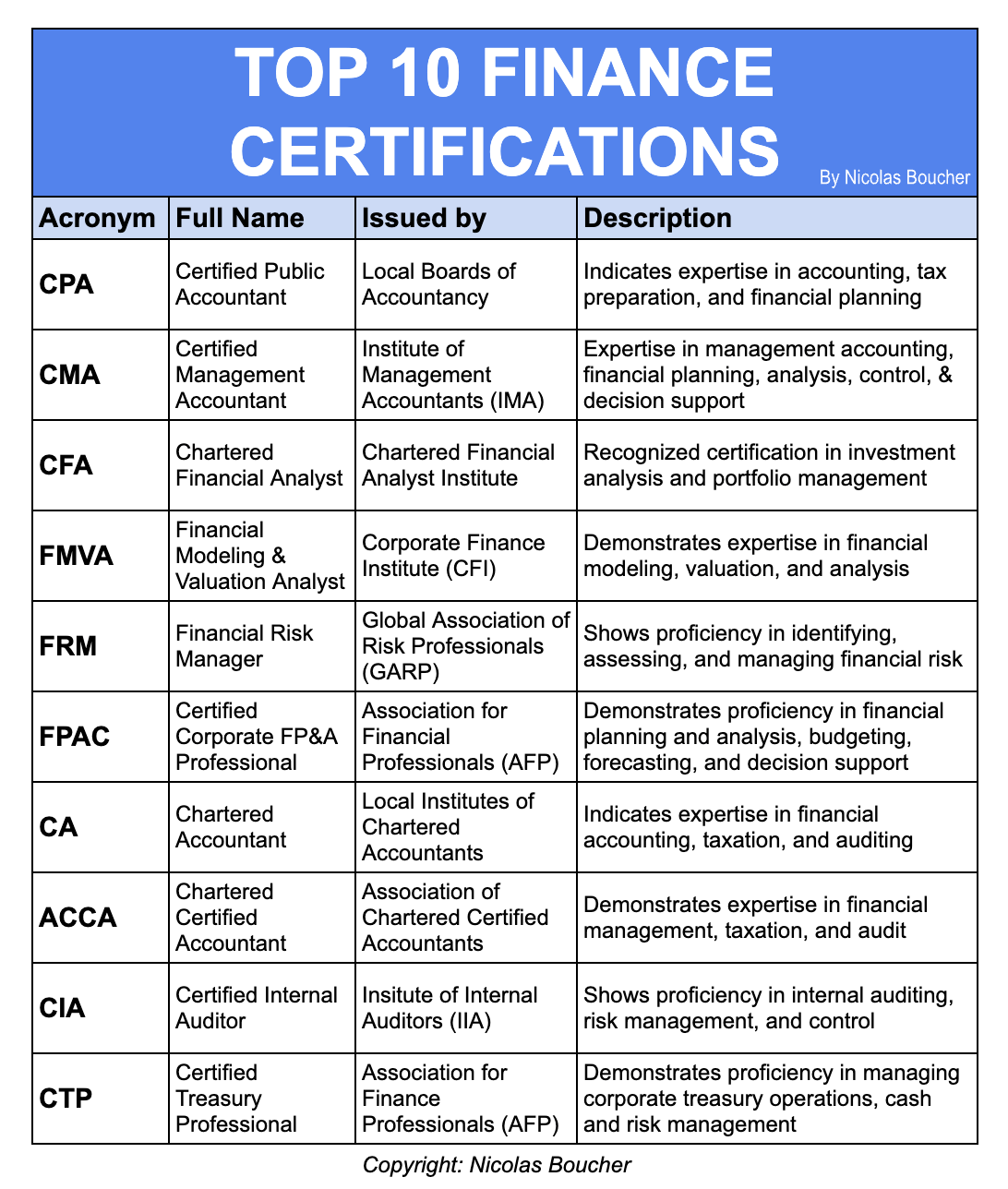

Focus on gaining comprehensive experience in various financial roles, from accounting to strategic planning. Pursue advanced degrees or certifications (e.g., CPA, CFA, MBA) and seek mentorship from established CFOs. Regularly participate in executive training programs to refine leadership and decision-making abilities.

#2: Controller

Key Responsibilities:

Directing and coordinating all accounting operational functions.

Key Skills:

- Technical Knowledge: Stay updated on accounting standards and regulations.

- Proficient in Financial Software: Master various accounting software and ERP systems.

- Internal Controls: Develop and maintain robust internal control systems.

How to Progress:

Build a strong foundation in accounting through certifications like CPA or CMA. Gain experience in different areas of accounting, such as audit and compliance. Seek roles with increasing responsibility to develop leadership and management skills.

#3: Financial Planning & Analysis (FP&A)

Key Responsibilities:

Manages financial analysis, budgeting, and forecasting activities.

Key Skills:

- Budgeting: Learn to create and manage detailed budgets.

- Forecasting: Develop skills in predicting financial trends and outcomes.

- Financial Analysis: Enhance your ability to analyze financial data and generate insights.

How to Progress:

Gain experience in various financial roles to understand different aspects of business operations. Pursue certifications like CFA or FP&A and continuously improve your analytical and forecasting abilities. Network with professionals in the industry to stay abreast of best practices and emerging trends.

#4: Treasury Team

Key Responsibilities:

Managing financial resources, ensuring liquidity, and optimizing capital structure.

Key Skills:

- Analytical Proficiency: Hone your ability to analyze financial data and market trends.

- Effective Communication: Develop strong communication skills to liaise with banks, investors, and internal teams.

- Adaptability: Be flexible in responding to market changes and financial challenges.

- Strategic Thinking: Enhance your ability to think strategically about financial resource management.

How to Progress:

Start with roles in financial analysis or corporate finance to build a strong understanding of financial management. Gain experience in treasury operations and consider certifications like CTP (Certified Treasury Professional). Develop a solid network within the finance industry.

#5: Accounting Team

Key Responsibilities:

Financial closing, accounts payables & receivables, reconciliation.

Key Skills:

- Knowledge of Accounting Standards: Stay current with GAAP or IFRS.

- Proficiency in Accounting Software: Master accounting software and ERP systems.

- Internal Controls: Develop and implement effective internal control systems.

How to Progress:

Begin with entry-level accounting roles and seek opportunities to work on different aspects of financial reporting. Obtain certifications such as CPA or ACCA and pursue continuous education to keep up with changing standards and technologies.

#6: Tax Team

Key Responsibilities:

Prepare tax provisions, returns & reports. Find solutions to complex tax issues.

Key Skills:

- Tax Skills: Deepen your understanding of tax laws and regulations.

- Written Communication: Improve your ability to communicate complex tax issues clearly.

- Compliance: Ensure adherence to tax compliance requirements.

How to Progress:

Start in tax advisory or compliance roles and gain experience with different types of tax returns and issues. Obtain relevant certifications like CPA or EA (Enrolled Agent). Stay updated on tax laws and participate in continuous learning opportunities.

#7: Business Partnering

Key Responsibilities:

Own the relationship with the operational departments. Manage & prioritize demand.

Key Skills:

- Communication: Strengthen your communication skills to effectively partner with operational departments.

- Organization: Enhance your ability to manage and prioritize multiple demands.

- Influence: Develop persuasive skills to influence business decisions.

How to Progress:

Gain experience in various business functions to understand operational needs. Develop strong interpersonal skills and seek roles that involve cross-functional collaboration. Consider further education in business management or leadership.

#8: Business Intelligence (BI)

Key Responsibilities:

Gather, analyze, compile & structure data. Manage BI software, dashboards & reports.

Key Skills:

- Data Analytics: Improve your skills in analyzing and interpreting data.

- BI Software: Master BI tools like Tableau, Power BI, or others.

- Visualization: Learn to create clear and impactful data visualizations.

- Demand Management: Develop skills to manage and prioritize data requests.

How to Progress:

Start with roles in data analysis or IT to build a strong technical foundation. Gain expertise in BI tools and software. Continuously update your skills through certifications and courses in data science, analytics, and BI tools.

Bonus: 30 Finance Jobs

Here is a list of 30 existing jobs for finance professionals:

1. Chief Financial Officer (CFO) – Manages financial operations of a company.

2. Financial Controller – Oversees accounting and financial reporting for a company.

3. Treasurer – Manages a company’s cash flow and investments.

4. Mergers & Acquisitions (M&A) Analyst – Analyzes potential acquisitions or mergers for a company.

5. Financial Planning & Analysis (FP&A) Manager – Analyzes financial data to support business decisions.

6. Accountant – Prepares and maintains financial records for individuals and organizations.

7. Investor Relations Manager – Communicates with investors and analysts about a company’s financial performance.

8. Internal Auditor – Ensures a company’s financial and operational processes are efficient and effective.

9. Tax Manager – Manages a company’s tax compliance and strategy.

10. Credit Analyst – Evaluates creditworthiness of clients or companies.

11. Financial Compliance Officer – Ensures a company complies with financial regulations.

12. Payroll Specialist – Calculates and processes employee payroll.

13. Accounts Receivable Accountant – Processes incoming payments from customers.

14. Accounts Payable Accountant – Processes outgoing payments to vendors and suppliers.

15. Cost Estimator – Calculates the cost of producing a product or service.

16. Inventory Accountant – Manages a company’s inventory and cost of goods sold.

17. Risk Manager – Identifies and mitigates potential financial risks for organizations.

18. Financial Reporting Manager – Manages a company’s financial reporting process.

19. Business Controller – Analyzes and manages a company’s overall financial performance.

20. Commercial Controller – Analyzes and manages a company’s sales and marketing activities.

21. Project Controller – Analyzes and manages the financial aspects of a project.

22. Industrial Controller – Analyzes and manages the financial performance of a manufacturing or industrial operation.

23. Internal Control Manager – Ensures a company’s compliance with internal control procedures.

24. Reporting Analyst – Develops and produces reports on a company’s performance.

25. Business Intelligence Analyst – Analyzes data and develops insights to support business decisions.

26. Data Analyst – Collects, cleans, and analyzes data to support business decisions.

27. Actuary – Analyzes financial risk using statistics and modeling techniques.

29. Portfolio Manager – Manages a portfolio of investments for an organization.

30. Budget Analyst – Analyzes and manages a company’s budget.

Last Words

Remember, gaining experience and improving your skills is key. Keep learning, stay curious, and don’t forget to network with others in your field. With dedication and hard work, you can reach your professional goals in finance.

Reminder

Take action and accelerate your FP&A career with the unique [FP&A Wharton Certificate program], which is in collaboration with Wall Street Prep. [Become irreplaceable and earn your deserved promotion!]

FAQ

Q: How can I progress to the role of Chief Financial Officer (CFO)?

A: To progress to a CFO role, gain comprehensive experience across various financial roles, from accounting to strategic planning. Pursue advanced degrees or certifications (e.g., CPA, CFA, MBA), seek mentorship from established CFOs, and participate in executive training programs to refine leadership and decision-making skills.

Q: What steps should I take to become a successful Controller?

A: Start by building a strong foundation in accounting with certifications like CPA or CMA. Gain experience in different areas of accounting, such as audit and compliance, and seek roles with increasing responsibility to develop your leadership and management skills.

Q: What is the best way to advance in Financial Planning & Analysis (FP&A)?

A: To advance in FP&A, gain experience in various financial roles to understand different aspects of business operations. Pursue certifications like CFA or FP&A, continuously improve your analytical and forecasting abilities, and network with industry professionals to stay updated on best practices and emerging trends.

Q: How do I progress in a Treasury role?

A: Start with roles in financial analysis or corporate finance to build a solid understanding of financial management. Gain experience in treasury operations, consider certifications like CTP (Certified Treasury Professional), and develop a strong network within the finance industry.

Q: What are the key steps to advance in an Accounting Team?

Begin with entry-level accounting roles and seek opportunities to work on different aspects of financial reporting. Obtain certifications such as CPA or ACCA, and pursue continuous education to stay current with changing standards and technologies.