As a finance professional, it’s important to stay up-to-date with the latest industry trends and best practices. One way to do this is by obtaining professional finance certifications.

These certifications not only demonstrate your expertise in a particular area but also increase your value to employers and clients.

In this blog post, we will discuss the top certifications for finance professionals, including their benefits, examples, and tips.

Table of Contents

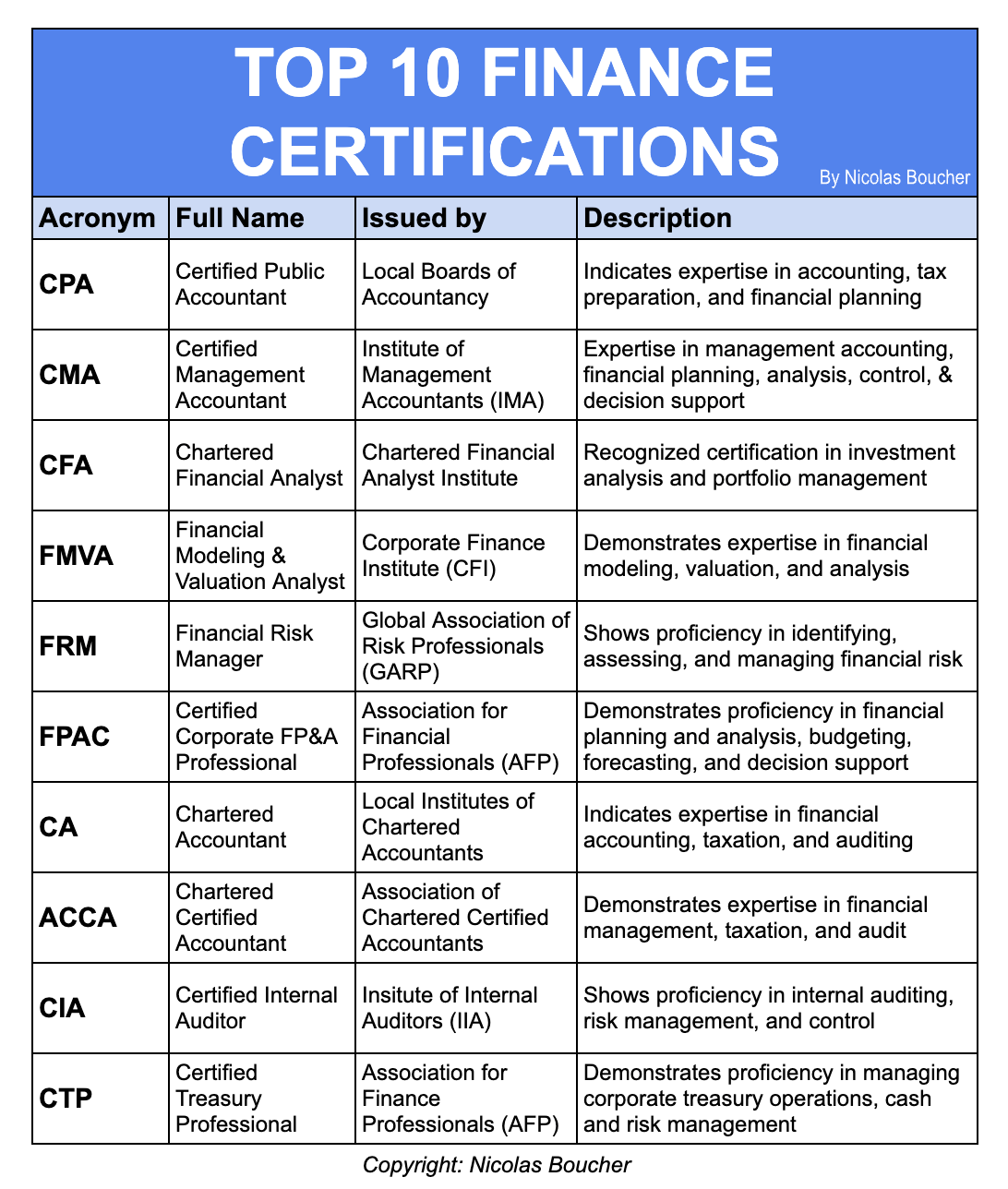

Top 10 Finance Certifications

Here are the explanations of the top 10 finance certifications.

CPA – Certified Public Accountant

US State Boards of Accountancy offers the Certified Public Accountant (CPA) certification.

This certification indicates expertise in accounting, tax preparation, and financial planning.

In other words, CPAs can work in a variety of industries, including public accounting, corporate finance, government agencies, and non-profit organizations.

Some examples of CPAs include CEOs like Tim Cook of Apple and Jeff Immelt of General Electric.

CMA – Certified Management Accountant

The Certified Management Accountant (CMA) certification is offered by the Institute of Management Accountants (IMA).

Therefore, this certification demonstrates proficiency in financial planning, analysis, control, and decision support.

Most importantly, CMAs can work in various industries, including manufacturing, healthcare, education, and government agencies.

Some examples of CMAs include the CFOs of companies like Intel and Procter & Gamble.

CFA – Chartered Financial Analyst

The Chartered Financial Analyst (CFA) certification is offered by the Chartered Financial Analyst Institute.

Also, this certification is recognized as a leading certification in investment analysis and portfolio management.

Therefore, CFAs can work in various industries, including investment banking, asset management, and hedge funds.

For example, CFAs include Warren Buffet of Berkshire Hathaway and Charles Schwab of Charles Schwab Corporation.

FMVA – Financial Modeling and Valuation Analyst

The Financial Modeling and Valuation Analyst (FMVA) certification is offered by the Corporate Finance Institute (CFI).

This certification demonstrates expertise in financial modeling, valuation, and analysis.

FMVAs can work in various industries, including investment banking, private equity, and corporate finance.

Some examples of FMVAs include professionals working in investment banks like Goldman Sachs and Morgan Stanley.

FRM – Financial Risk Manager

The Financial Risk Manager (FRM) certification is offered by the Global Association of Risk Professionals (GARP).

This certification shows proficiency in identifying, assessing, and managing financial risk.

FRMs can work in various industries, including banking, insurance, and consulting.

For example, FRMs include professionals working at companies like JPMorgan Chase and PwC.

FPAC – Certified Corporate FP&A Professional

The Association for Financial Professionals (AFP) offers the Certified Corporate FP&A Professional (FPAC) certification.

This certification demonstrates proficiency in financial planning and analysis, budgeting, forecasting, and decision support.

FPACs can work in various industries, including corporate finance, consulting, and government agencies.

For instance, FPACs include professionals working at companies like Amazon and Microsoft.

CA – Chartered Accountant

The Local Institutes of Chartered Accountants issues the Chartered Accountant (CA) certification/

This certification indicates expertise in financial accounting, taxation, and auditing.

As a result, CAs can work in various industries, including public accounting, corporate finance, and government agencies.

Moreover, some examples of CAs include professionals working at companies like KPMG and Deloitte.

ACCA – Chartered Certified Accountant

The Association of Chartered Certified Accountants offers the Chartered Certified Accountant (ACCA) certification.

This certification demonstrates expertise in financial management, taxation, and audit. ACCAs can work in various industries, including accounting firms, financial institutions, and consulting.

For instance, ACCAs include professionals working at companies like HSBC and Ernst & Young.

CIA – Certified Internal Auditor

The Certified Internal Auditor (CIA) certification is offered by the Institute of Internal Auditors (IIA).

This certification shows proficiency in internal auditing, risk management, and control.

CIAs can work in various industries, including corporate governance, internal audit, and compliance.

In addition, some examples of CIAs include professionals working at companies like Nike and Pfizer.

CTP – Certified Treasury Professional

The Association for Finance Professionals (AFP) offers the Certified Treasury Professional (CTP) certification.

This certification demonstrates proficiency in managing corporate treasury operations, cash, and risk management. Therefore, CTPs can work in various industries, including banking, corporate finance, and government agencies.

Additionally, some examples of CTPs include professionals working at companies like Bank of America and Citibank.

Tips for Choosing the Right Certification

Choosing the right certification can be overwhelming, so here are a few tips to help you make the best decision:

- Research the different certifications and their requirements to ensure they align with your career goals and interests.

- Consider the time commitment and cost associated with obtaining the certification.

- Furthermore, look for certifications that your industry and potential employers or clients will recognize

- Seek out advice and recommendations from colleagues or mentors who have obtained similar certifications.

- Moreover, consider the value the certification will add to your career and the opportunities it may provide.

Conclusion – Professional Certificate Can Determine Your Career

Obtaining a professional certification can enhance your career in finance and demonstrate your expertise in a particular area.

Whether you want to work in accounting, financial planning, risk management, or treasury operations, there is a certification for you.

However, there is a better alternative!

Are you ready to take your finance skills to the next level? Sign up now for our course and start mastering the fundamentals of finance today!

Here’s why our course is better than obtaining financial certifications:

- It’s cheaper: Why would you pay thousands of dollars for certification when you can learn the same material for a fraction of the cost?

- Real-life examples: Our course is packed with real-world examples to help you understand financial concepts and apply them in practical situations.

- Taught by a finance thought leader: With over 14 years of experience and 400k followers, I’ve seen it all when it comes to finance. You’ll learn from someone who’s been there and done that.

- Faster: Our course is designed to help you learn quickly and efficiently. You won’t waste any time on material that isn’t relevant to your goals.

- Lifetime access: Once you sign up for our course, you’ll have lifetime access to the material. You can revisit it anytime you need a refresher or want to learn more.

Finally, don’t miss out on this opportunity to take your finance skills to the next level. Click the link to sign up now!

Key Takeaways

- Professional finance certifications enhance industry knowledge and demonstrate expertise.

- Top certifications include CPA, CMA, CFA, FMVA, FRM, FPAC, CA, ACCA, CIA, and CTP.

- Research certification requirements, consider industry recognition, and seek advice before choosing.

- Certifications can boost careers in accounting, financial planning, risk management, or treasury operations.

- An alternative to certifications is a comprehensive course offering cost-effectiveness, real-life examples, expert instruction, efficiency, and lifetime access.

FAQ

1. Why should finance professionals consider obtaining certifications?

Certifications showcase expertise, increase value to employers and clients, and validate proficiency in specific areas of finance.

2. What are some examples of finance certifications?

Examples include CPA (Certified Public Accountant), CMA (Certified Management Accountant), CFA (Chartered Financial Analyst), and FMVA (Financial Modeling and Valuation Analyst).

3. How do I choose the right certification for my career goals?

Research certification requirements, consider industry recognition, assess time and cost commitments, seek advice from mentors, and evaluate the value it adds to your career.

4. Are there alternatives to obtaining finance certifications?

Yes, a comprehensive finance course can offer cost savings, real-world examples, expert instruction, efficient learning, and lifetime access to materials.

5. What benefits can professional certifications or courses provide to finance professionals?

Certifications and courses enhance industry knowledge, validate skills, demonstrate expertise, and open up opportunities for career advancement in various finance sectors.