Our capacity to adapt and pick up new finance skills is crucial for career development and enhancing corporate outcomes, as the pandemic has taught us. For you and your team to succeed in the shifting market dynamics, it is essential to update and develop skills. How can you improve your career as a Finance professional?

Here are the skills you need to develop to accelerate your career in Finance.

Analytical Finance Skills

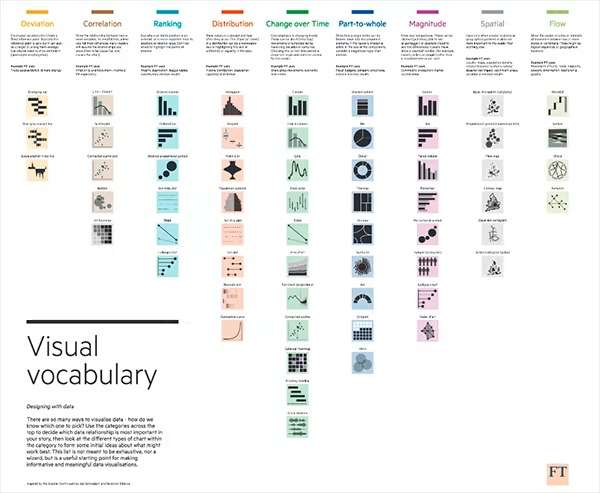

Learn how to use the right analysis methods, such as:

- Price Volume Mix

- Sensitivity analysis

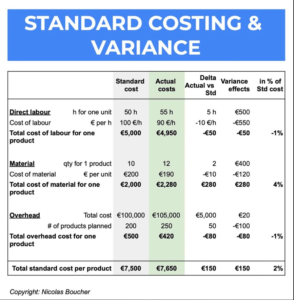

- Variance analysis

- Horizontal analysis

- Vertical analysis

Almost every day, finance professionals must deal with difficult business scenarios. In other words, from obtaining resources for financial research to keeping an eye on finances, finance managers and executives need to be able to understand and evaluate a situation. In short, they should be able to think critically and make decisions under pressure using the methods.

Basic Accounting Skills

First, to understand the impact of business events on financials, you need a basic understanding of accounting and learn how the three statements (P&L, Balance Sheet and Cash Flow) work together. Second, you need it because employers search for people who have a fundamental knowledge of accounting, including how to create and manage cash flow statements, prepare balance sheets, and do other accounting-related tasks. Therefore, in order to have a competitive advantage over rivals, you should be well-versed in core accounting concepts, procedures, and tools.

Soft Skills

Develop the following soft skills to deliver value to your organization:

- Communication (written and verbal)

- Interpersonal

- Influencing

- Put yourself in other people’s shoes

Explaining complicated financial ideas in simple terms orally and in writing becomes crucial since the finance team now must work collaboratively with several other teams. Additionally, you should be able to converse with industry experts and answer inquiries from a wide range of people regarding the performance and objectives of the organization.

The Bottom Line – Importance of Finance Skills

The skills you posses in finance will play huge role in shaping your career. Therefore, if you are willing to develop your analysis skills, I am here to help you.

Finally, I have a program to help finance professionals upskill themselves and accelerate their career. To get access to that program you can take my course.