Many of you asked me how to learn Financial Modeling. Even if I considered myself knowledgeable in model construction, I recently discovered that there was much more to learn. Therefore, the last weekend I finally decided to act and took a course on Financial Modeling.

Here, as a result, I will share with you what I learned.

Table of Contents

Why I Took a Financial Modeling Course?

First, here is why I took a course in the first place…

In my 14 years of experience, I have built a lot of financial models for audit clients, business cases, and for budgets. But thanks to LinkedIn, I met experts in Financial Modeling who were building models every day and used them in other contexts (company valuation, raising capital, issuing debt, private equity, real estate, etc.).

This is why I finally took the dive and jumped into the course of an expert (Chris Reilly) to upskill myself.

Here is what I learned from my research on Financial Modeling and from Chris Reilly’s course (Chris Reilly authorized me to share the information coming from his course).

When to Use Financial Modeling?

Financial Modeling is used in many industries and in many finance roles.

Here are some of the situations where you need to use Financial Modeling:

- Raise capital

- Grow the business organically

- Sell or divest business units

- Allocate capital

- Budget and forecast

- Value a business

- Financing through debt

Also, here are some of the financial jobs requiring modeling skills:

- Investment banker

- Financial analyst

- Private equity analyst

- Strategy consultant

- Auditor

- FP&A analyst

- Controller

- Credit analyst

Although it’s commonly assumed that Analysts are the ones primarily doing the modeling, I learned nearly all Finance positions at a company would also have some exposure, even CFOs.

Professional Financial Modeling Process

In the course I took, I first learned how to optimize the structure of my financial model.

Here are the five steps I found helpful:

- Start with raw data

- Then build your sub-schedules linked to the raw data and assumptions (headcount, expenses, investments…)

- Consolidate the information in the three statements (Income Statements, Balance Sheets, Cash Flow Statement)

- Build a summary sheet for management communication and executive summary presentations

- Finish with an error check (best practice is to have an error checking sheet)

Standards in Formatting

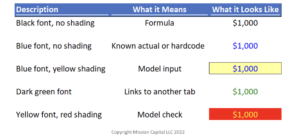

Ultimately, this is something I was not doing before, and I started doing it when I took the course. Now by using the same standards over and over, I can simplify the way I work with Excel and reduce the number of decisions I have to make on the format.

Here is an example of what standards in formatting can look like:

Another “pro tip” I found in my research was integrating a Loom video recording into the financial model. You can quickly record a set of instructions and create a video link directly inside the model using the =HYPERLINK function.

This is a great way to “humanize” the model and help new users navigate the file when they first open it.

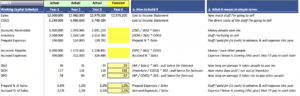

How to Calculate Each Line Item of The Three Financial Statements

If, like me, you have a strong understanding of accounting; you might probably think that you can calculate financial ratios without help. But the template provided (see one example below) really helped me. It had everything in one place.

Each line item is defined in simple terms, and you even get an indication of how to calculate it.

This is something that can make you save a lot of time but also help you ensure that you and your team have the same standards in calculating financial ratios.

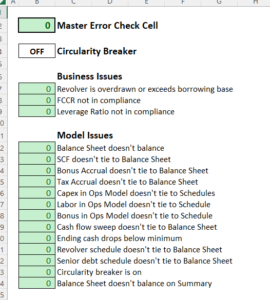

How to Proof Check Your Model with A Control Panel

Until this weekend, I rarely saw a relevant control panel in an Excel file.

But now I know I should add this module to nearly all my Excel files.

Here is why it is helpful:

- If you’re building a time series model, an Actual date field (linked to all the dynamic cells you want to be based on your actual date), so your model can quickly update with the latest actuals once they’re available.

- Error-checking cells that flag all model issues are ideally separated into “model issues” (problems with the file) and “business issues” (strategic indicators for the company).

- Link the “Master Error Check Cell” to all other sheets in your workbook, so you’re notified of issues the right way.

In the course, you get great examples of where to have error checks (for example, there is a check about the cash movement in the balance sheet being equal to the cash flow statement).

I’ve included an example below, although this one does not have the actual date field I mentioned above.

Conclusion

These main five points are what I learned thanks to my research and Chris’ courses. Also, to top it off, I learned some great best practices for the models I’ll build in the future. If you are interested in learning professional Financial Modeling, Chris gave me an affiliate link for his course.

My recommendation is to start with this course (that’s the one I took) to master the three statements in under two hours.

Here are three other articles from my blog that could be helpful for you: