The finance industry is undergoing a remarkable transformation with the advent of advanced technologies.

One such innovation, ChatGPT, is revolutionizing the way financial institutions operate.

Moreover, powered by artificial intelligence and natural language processing, ChatGPT enables human-like conversations, enhancing customer service, streamlining processes, and facilitating more efficient decision-making.

So, we will dive deep into how ChatGPT is changing the finance industry and discuss ways to adapt to this transformative technology.

Table of Contents

How Is ChatGPT Changing The Finance Industry?

Here are the ways ChatGPT is transforming the finance industry.

#1: Improved Customer Service

ChatGPT empowers financial institutions to provide exceptional customer service by offering personalized assistance, answering queries, and addressing concerns promptly.

In addition, its natural language understanding capabilities allow it to interpret customer messages accurately, ensuring a seamless and satisfying customer experience.

#2: Enhanced Efficiency

With ChatGPT, financial institutions can automate repetitive tasks, such as data entry and basic inquiries, freeing up valuable time for finance professionals to focus on more complex and strategic activities.

This boosts operational efficiency and enables employees to engage in higher-value work.

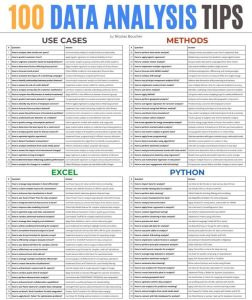

#3: Advanced-Data Analysis

ChatGPT’s ability to analyze financial data provides you with increased productivity.

Also, it can identify patterns, detect anomalies, and generate real-time reports, empowering finance professionals to make informed decisions and optimize financial strategies.

#4: Risk Assessment and Fraud Detection

By leveraging ChatGPT, financial institutions can improve risk assessment and fraud detection mechanisms.

Additionally, ChatGPT’s advanced algorithms can identify suspicious activities, detect fraudulent transactions, and mitigate risks proactively, enhancing the overall security of financial operations.

#5: Streamlined Compliance

Compliance requirements in the finance industry are complex and demanding.

ChatGPT assists in navigating these challenges by providing real-time compliance guidance and ensuring adherence to regulatory frameworks.

As a result, its ability to process vast amounts of information and stay up-to-date with changing regulations minimizes the risk of non-compliance.

How Can You Adapt to It?

To effectively adapt to the transformative impact of ChatGPT on the finance industry, consider the following strategies:

Embrace Continuous Learning

Stay updated with the latest advancements in ChatGPT and AI technologies.

In other words, invest time in understanding how ChatGPT can be leveraged to enhance your finance-related skills and knowledge.

Nurture Human-AI Collaboration

Recognize that ChatGPT is a tool that can complement human expertise.

Incorporate the collaboration between finance professionals and ChatGPT, leveraging its capabilities to augment decision-making processes rather than replace human judgment.

Cultivate Soft Skills

As ChatGPT automates routine tasks, focus on developing soft skills that cannot be easily replicated by AI.

Skills such as critical thinking, creativity, and emotional intelligence will become increasingly valuable in the evolving finance industry.

Adapt to Changing Roles

As ChatGPT handles routine inquiries, finance professionals can shift their focus towards higher-level tasks, such as strategic planning, relationship management, and complex financial analysis.

Moreover, embrace these evolving roles to stay relevant in the changing landscape.

Prioritize Data Security and Ethical Considerations

As ChatGPT handles sensitive financial data, prioritizes data security, and adheres to ethical guidelines.

Furthermore, make sure that customer privacy is protected, and data usage aligns with regulatory requirements and industry best practices.

Conclusion

ChatGPT is reshaping the finance industry, revolutionizing customer service, improving efficiency, enabling advanced data analysis, enhancing risk assessment, and streamlining compliance.

Therefore, adapting to this transformative technology requires a mindset of continuous learning, embracing human-AI collaboration, nurturing soft skills, adapting to changing roles, and prioritizing data security and ethics.

By harnessing the power of ChatGPT effectively, finance professionals can thrive in this new era of intelligent automation.

If you are a manager, ChatGPT can help you make your team more productive.

If you want to train your team on how to use ChatGPT in a business context, I can help you.

I have launched the first and only ChatGPT training for business. I have still some slots for the next 4 weeks but they are going fast. Check this page if you want to bring your team into a position to leverage AI for their work.

Key Takeaways

- ChatGPT enhances customer service, providing personalized assistance and quick query resolution.

- It boosts efficiency by automating routine tasks, freeing up time for strategic activities.

- Advanced data analysis capabilities enable more accurate predictions and informed decision-making.

- ChatGPT strengthens risk assessment and fraud detection in the finance industry.

- Prioritizing data security and ethical considerations is crucial when leveraging ChatGPT.