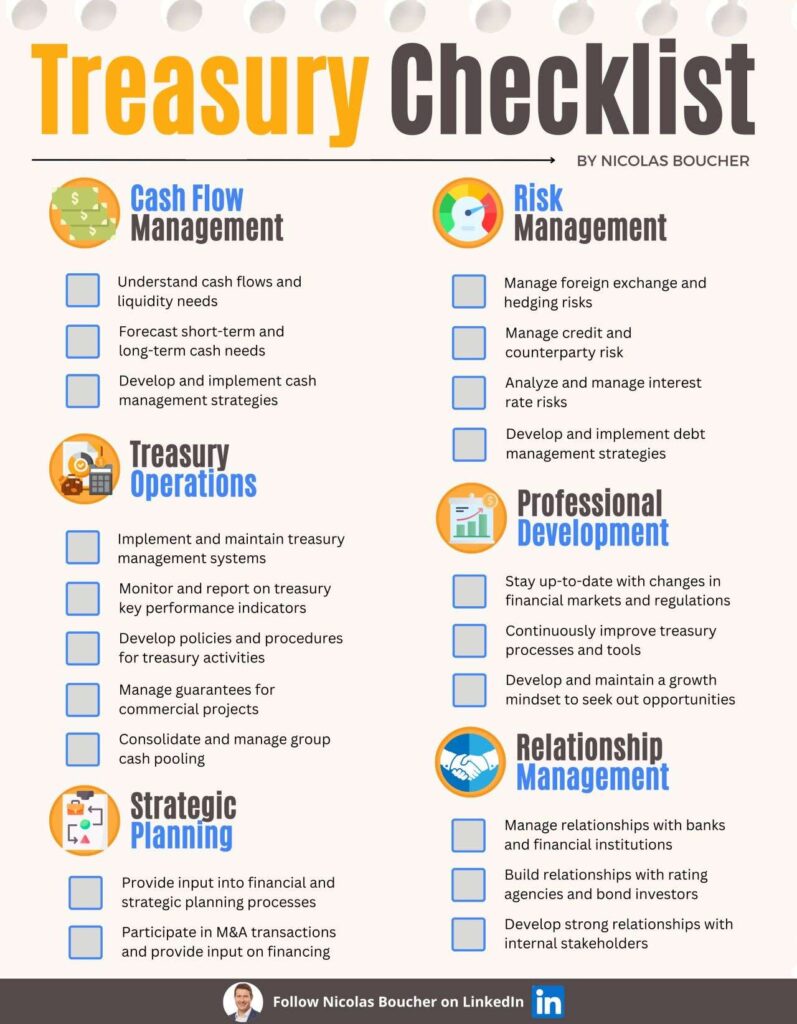

The treasury function plays a crucial role in maintaining liquidity, managing risks, and optimizing financial resources. That is to say, we prepared a treasury checklist of the 20 most important tasks the treasury team needs to focus on.

Furthermore, this checklist empowers CFOs and finance professionals to prioritize key activities that contribute to maintaining financial stability and driving strategic decision-making.

Therefore, here is a detailed treasury checklist comprising 20 essential tasks that finance professionals and CFOs should prioritize for effective financial management.

Table of Contents

Why Is It Important?

Above all, an effective treasury function is vital for businesses to maintain financial stability, make strategic decisions, and seize growth opportunities.

As a result, the treasury checklist serves as a guide to ensure that critical tasks are completed, risks are managed, and resources are optimized.

By following this checklist, treasury professionals can enhance cash management capabilities, mitigate risks, and contribute to the overall financial health of the organization.

Top 20 Tasks for Effective Treasury Function

Here are the 20 critical tasks for ensuring an effective treasury function in your company.

#1: Understand Cash Flows and Liquidity Needs

Gain a comprehensive understanding of the company’s cash flows and liquidity requirements to effectively manage cash positions.

#2: Develop and Implement Cash Management Strategies

Formulate strategies and policies to optimize cash utilization, streamline collections and disbursements, and enhance working capital management.

#3: Forecast Short-Term and Long-Term Cash Needs

Develop accurate cash flow forecasts in order to anticipate funding requirements and ensure sufficient liquidity.

#4: Manage Foreign Exchange and Hedging Risks

Monitor and manage currency exposures and implement appropriate hedging strategies to mitigate foreign exchange risks.

#5: Manage Relationships with Banks and Institutions

Cultivate strong relationships with banking partners, financial institutions, and other stakeholders to optimize cash management solutions and access financing options.

#6: Implement and Maintain Treasury Management Systems

Leverage technology solutions to automate and streamline treasury processes, enhance efficiency, and improve decision-making capabilities.

#7: Monitor and Report on Treasury KPIs

Establish and track key performance indicators (KPIs) in order to measure and evaluate treasury performance, liquidity levels, and risk management effectiveness.

#8: Develop and Implement Debt Management Strategies

Formulate strategies for debt issuance, refinancing, and repayment to optimize debt structure and cost of borrowing.

#9: Manage Credit and Counterparty Risk

Assess and monitor credit risks associated with banking relationships, investments, and other financial transactions to safeguard the organization’s financial interests.

#10: Analyze and Manage Interest Rate Risks

Evaluate and manage exposure to interest rate fluctuations by implementing appropriate hedging strategies or debt structures.

#11: Build Relationships with Rating Agencies and Bond Investors

Establish and maintain relationships with rating agencies and bond investors in order to ensure favorable credit ratings and access to capital markets.

#12: Provide Input into Financial and Strategic Planning Processes

Collaborate with finance and strategy teams to provide treasury-related insights and support financial planning initiatives.

#13: Develop Strong Relationships with Internal Stakeholders

Collaborate with various departments, including finance, accounting, and operations, to understand their cash flow needs. Also, to gain an understanding of the treasury activities with organizational objectives.

#14: Participate in M&A Transactions and Provide Input on Financing

Contribute to merger and acquisition activities by assessing financing options. Additionally, by performing due diligence, and providing financial insights.

#15: Develop Policies and Procedures for Treasury Activities

Establish robust policies and procedures to ensure compliance, effective risk management, and efficient treasury operations.

#16: Stay Up-to-Date with Changes in Financial Markets and Regulations

Stay informed about market trends, regulatory changes, and industry best practices to adapt treasury strategies accordingly.

#17: Continuously Improve Treasury Processes and Tools

Regularly evaluate and enhance treasury processes, systems, and tools in order to increase efficiency, accuracy, and control.

#18: Develop and Maintain a Growth Mindset to Seek out Opportunities for Professional Development

Foster a mindset of continuous learning and seek opportunities to enhance treasury knowledge and skills.

#19: Manage Guarantees for Commercial Projects

Assess and manage financial guarantees related to commercial projects, ensuring compliance and minimizing risk exposure.

#20: Consolidate and Manage Group Cash Pooling

Coordinate and optimize cash flows within a group of companies through cash pooling arrangements in order to maximize efficiency and utilization of available funds.

Bonus/Last Tips

- Implement robust cybersecurity measures to safeguard financial information and prevent fraud.

- Regularly review and update treasury policies and procedures to align with evolving business needs and regulatory requirements.

- Establish contingency plans to address potential liquidity crises or adverse market conditions.

The Bottom Line

Following this treasury checklist is crucial for effectively managing cash flow, mitigating risks, and optimizing financial resources.

By prioritizing the tasks outlined in this treasury checklist, professionals can ensure efficient cash management, enhance liquidity, and contribute to the overall financial health of the organization.

Therefore, with a strategic and systematic approach to treasury activities, businesses can navigate the complexities of the financial landscape and position themselves for long-term success.

Finally, if you want to receive more finance tips like this, feel free to sign up for my newsletter. Also, if you subscribe, every two weeks, you will receive an email from where I share best practices, career advice, templates, and insights for Finance Professionals.

Key Takeaways

- Efficient cash flow management for liquidity optimization.

- Proactive risk mitigation for foreign exchange, interest rates, and credit.

- Strategic decision-making support for financial and strategic planning.

- Strong collaboration and stakeholder management for effective treasury operations.

- Continuous improvement and adaptability to evolving market conditions.