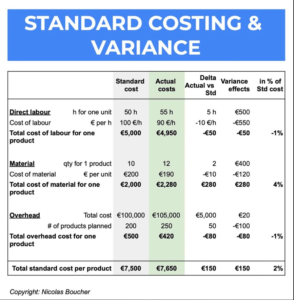

Businesses utilize standard costing and variances as a method to monitor their expenses. In other words, it entails establishing a “standard” cost for each good or service and measuring actual costs to these benchmarks. Additionally, you can track direct and indirect expenses using standard costing.

On the other hand, variance analysis is a method for contrasting actual costs with standard costs. This comparison can assist managers in finding areas where costs are greater than anticipated and, if necessary, take corrective measures.

To have a career in Finance, you need to know how to calculate standard costing and variances.

Below is an extract of the lesson on standard costing included in my course.

Table of Contents

Defining Standard Costing and Variances

Method

With the standard cost method, you value your product using expected costs rather than actual costs. This simplifies the accounting of producing units.

Definition

The Standard cost of a finished product is composed of the following:

- Direct material

- Direct labor

- Manufacturing overhead

Direct material = Material standard price x standard material quantity for one product

Direct labor = Labor standard price (hourly rate) x standard number of hours used for one product

Manufacturing overhead = Overhead (indirect costs of manufacturing) allocated to one material using an allocation key.

Variance

For each of the three components listed above, there are 2 sources of variance: the usage and the price.

For example:

- Direct material will have a usage variance: how many quantities were used vs the standard quantity

- Direct Material will also have a material price variance: actual price vs standard price multiplied by actual quantity

Also, here is an example, and you can find this template in the course.

Other Types of Cost Accounting

- Activity Based Cost Accounting

- Marginal Cost Accounting

- Lean Accounting

The Bottom Line – Standard Costing and Variances

In every manufacturing or production process, standard cost variances are a necessary component. Therefore, to find out what is causing these variations and how to fix them, variance analysis is utilized.

Furthermore, an instrument for managing these variances is standard costing. As a result, they are very important to learn if you are pursuing a career as a finance professional.

In my online course I have 77 other chapters where you can learn from me the concepts to accelerate your career in finance.