Today, I will discuss the comparison of FP&A vs finance controller in this blog article to assist you in determining which is more suited to your present situation or long-term objectives.

Therefore, to decide which career route is best for you, educate yourself on the income ranges, work responsibilities, professional development possibilities, and skills needed for each position.

Which is best for your career out of the two professions that each bring unique obligations to the table?

Table of Contents

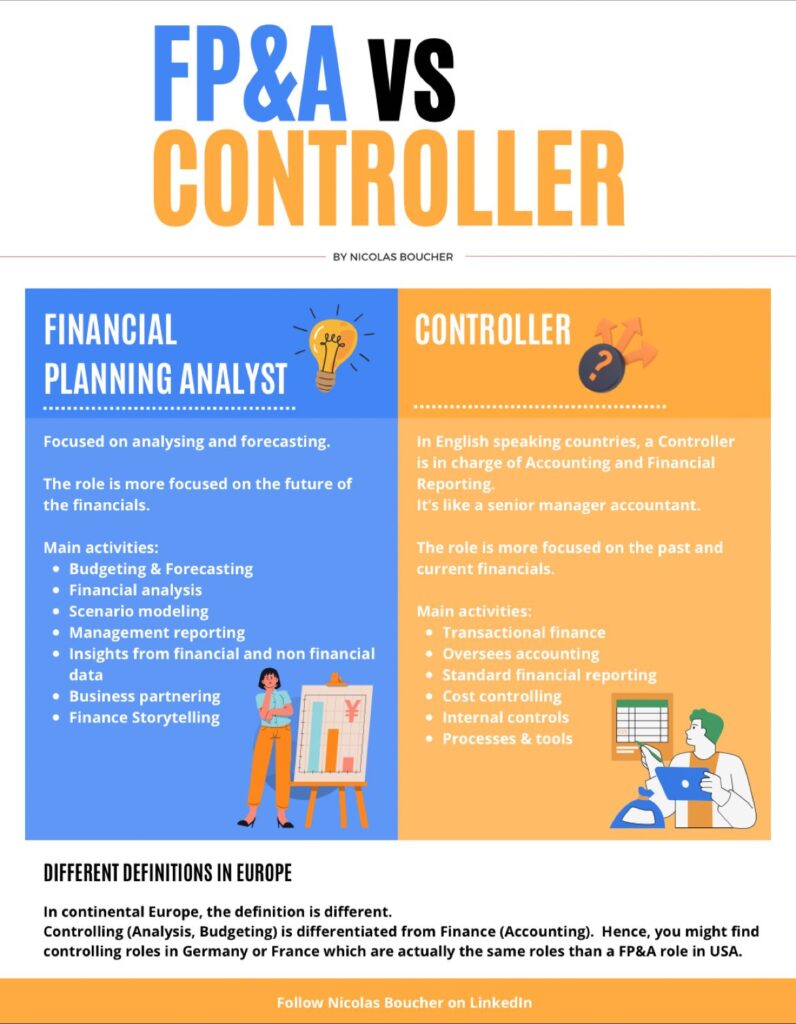

The Main Differences between FP&A vs Controller

Here are the distinctions between FP&A vs controller in finance and the descriptions of the jobs.

Controller in Finance

The senior-level manager who is responsible for managing a company’s daily financial operations is the financial controller. Financial controllers manage the accounting department and are in charge of the business’s accounts and records, and sometimes they call them “company historians.”

In essence, a financial controller serves as the chief accountant for a company.

Furthermore, they supervise accounting operations and guarantee that ledgers appropriately reflect the company’s cash inflow and outflow. Using accounting data, strategic controllers have an influence on corporate forecasting, planning, and decision-making.

Roles of a controller

- Controllers are responsible for controlling risk and protecting assets, so they serve as financial stewards. This involves making sure that internal procedures are being followed and that internal controls have been put in place.

- By directing the organization on the right path, controllers serve as financial strategists. For instance, if financial reporting input is required on the modules required, changes desired, or shortcomings of what is being given, a controller is frequently involved in accounting software deployment programs.

- Due to their high-level supervision of daily financial activities, controllers can also be financial operators. Additionally, this includes making sure that the purchasing, payment processes, payment remittance, and accounting software record-keeping processes all work according to plan.

- By establishing procedures and ensuring that the new plans are carried out, controllers serve as financial catalysts. Furthermore, this entails confirming that deadlines for external reporting or filing are up to date. And also that particular adjustments mandated by external regulatory organizations have been adhered to.

FP&A in Finance

Professionals in financial planning and analysis (FP&A) are in charge of a company’s financial planning, budgeting, and forecasting process. It is important to guide the executive team and the board of directors in making important decisions.

These individuals gather, compile, and analyze financial data from various departments inside the company to provide reports that offer data-driven responses to managerial inquiries.

Moreover, the FP&A department is moving further toward the future. Using best practices, it focuses on why things are happening as well as what is most likely to occur in the future rather than just what has happened or is happening right now.

Roles of FP&A

- FP&A is in charge of creating cash flow statements, variance reports that compare departmental budgets to actual spending, board reports, and profit and loss (P&L) statements. To complete these claims, data must be gathered from many departments (thus the need for business partnership skills), verified, and then combined. After that, the FP&A utilizes that to compute important financial metrics.

- Planning the budget and predicting the company’s future financial outcomes are among the more analytical duties of FP&A. The process of creating a budget involves analyzing financial statistics to decide how to distribute funds. In order to forecast, financial models must be in place that take into consideration business-specific as well as larger industries. Also, the economic trends might have an impact on sales and profit.

- FP&A specialists frequently examine financial accounts to determine which product or service lines have the best profit margins or make the largest contributions to net profit. The cost and income or profit from each department of the business may also be made.

- FP&A professionals map out the best-case, expected-case, and worst-case scenarios by entering various numbers for sales and order volume to determine how they will affect the company’s financial condition. This is the process of scenario planning.

- Ad-hoc reporting: These on-demand reports, usually requested either by CFO or controller, frequently offer a more thorough examination of a particular KPI or business division. To find the precise information the CEO needs, an analyst or director might have to extract figures from many other, more comprehensive reports. The FP&A team has the data it needs thanks to this reporting and modeling. Especially if it’s going on often, to provide senior management with prompt, accurate, and useful suggestions.

The Bottom Line – FP&A vs Finance Controller – What Is Better?

If you’re considering a career in finance, you may be thinking about becoming a financial controller or an FP&A analyst. No matter which one you choose, you need to have a strong CV, therefore use my tips and increase your chances of landing your dream job.

Both roles play a crucial role in the administration and planning of an organization’s finances. Yet, they are very different from one another.

Finance controllers supervise budgeting and make sure that spending stays within allotted limits. Meanwhile, FP&A analysts offer analyses and suggestions for performance enhancement. Therefore, your skill level and interests will determine the position that is best for you.

If you have attention to detail and love dealing with statistics, think about pursuing a position as a financial controller. If you prefer making strategic suggestions, think about applying for a position as an FP&A analyst. Whichever route you take, a career in finance can be financially and professionally successful.

If you liked this comparison of FP&A vs finance controller, you could find out more about CFO vs controller here.

Finally, if you want to learn the practices that helped many finance professionals, you can take my course.

Key Takeaways

- Roles: Controllers manage daily financial operations, while FP&A professionals focus on planning and analysis.

- Accounting vs Analysis: Controllers handle accounting and internal controls; FP&A analysts provide analysis and forecasting.

- Data Usage: FP&A gathers data for reports and decision-making; controllers maintain accurate records.

- Budgeting: FP&A creates budgets and forecasts; controllers ensure budget adherence.

- Skill Sets: Controllers need attention to detail; FP&A analysts require analytical and strategic thinking.

FAQ

1. What is the role of a financial controller?

- Financial controllers manage daily financial operations, oversee the accounting department, ensure accurate record-keeping, and play roles as financial stewards, strategists, operators, and catalysts.

2. What does an FP&A analyst do?

- FP&A analysts handle financial planning, budgeting, and forecasting, collecting and analyzing data from various departments to provide reports for decision-making. They also engage in scenario planning and provide strategic recommendations.

3. What are the primary responsibilities of controllers?

- Controllers focus on risk management, internal controls, accurate financial reporting, and adherence to budget limits. They ensure proper financial procedures, supervise financial activities, and contribute to strategic decisions.

4. How does FP&A differ from controllers in terms of focus?

- FP&A emphasizes forward-looking analysis and strategic planning, while controllers concentrate on historical accounting records, internal controls, and compliance.

5. Which career path should you choose: financial controller or FP&A analyst?

- Choose a financial controller if you enjoy meticulous accounting, internal controls, and budget oversight. Opt for an FP&A analyst role if you’re inclined towards data-driven analysis, strategic planning, and providing recommendations for performance improvement. Your skills and preferences should guide your decision.