Assessing the performance of finance teams is crucial for any company that wants to ensure its financial health and success. It is essential to identify the strengths and weaknesses of finance teams to improve their overall performance and make informed decisions.

However, evaluating the performance of finance teams can be a challenging task, and it requires a well-planned approach. Here, we will discuss how to assess the performance of finance teams and what factors to consider.

Table of Contents

Assessing The Performance of Finance Teams

Here is how you can assess the performance of finance teams.

Establish Clear Goals and Objectives

To assess the performance of finance teams, it is crucial to establish clear goals and objectives that align with the company’s strategic priorities. Furthermore, these goals and objectives should be specific, measurable, achievable, relevant, and time-bound (SMART).

Furthermore, once the goals and objectives are set, they should be communicated to the finance teams and regularly reviewed.

Measure Key Performance Indicators (KPIs)

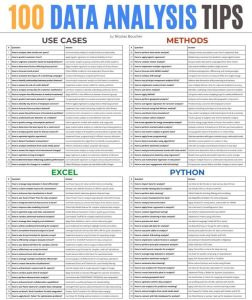

KPIs are critical metrics that help measure the success of finance teams in achieving their goals and objectives. Some of the commonly used KPIs for finance teams include time to conduct budget and planning process, time to close, reports created per finance employee, and rate of financial report errors.

Moreover, the KPIs should be tracked regularly and reviewed against the set goals and objectives. Grab the high-quality PDF of the top 100 KPIs for finance here.

Time to Conduct Budget and Planning Process

One of the most important financial KPIs for a finance department is the time it takes to conduct the budget and planning process.

Everyone detests creating budgets and plans. Because of this, there is a financial metric to determine how long it takes. So just because there is a time-tracking measure doesn’t imply you can compromise on quality.

How to improve

- Reduce iterations

- Use planning tools

- Make sure you have one single source of truth

- Communicate targets upfront

- Don’t start the budget process too early

Time to Close

There never seems to be sufficient time for a close when the quarter is about to end. Everyone constantly sends out emails in a frenzy to ensure all the expenditures are filed.

But, the ability to close fast and effectively is a hallmark of a well-functioning business—or one that makes use of quality financial reporting software.

How to improve

- Automate as many as possible bookings

- Limit manual transactions

- Have a closing checklist

- Communicate a clear closing plan of all tasks needed to perform before closing

- Anticipate problems

- Be pragmatic on small issues

Reports Created per Finance Employee

Although quantity isn’t always preferable to quality, this financial statistic aids in assessing the performance of the finance team and may assist pinpoint areas for development.

You can enhance this finance indicator through the usage of a financial reporting system.

How to improve

- Eliminate unnecessary information in reports

- Automate reports

- Use Bi tools

- Make sure you have a single source of truth

- Inquire demand for business

- Use power query to boost your productivity in excel reports

Rate of Financial Report Errors

Every financial team would want this measure to be zero. It isn’t always the case, though. Similar to the KPI stated before, financial reporting systems may give finance departments the right equipment to complete this task.

How to improve

Each time there is a mistake:

- Escalate it to the report owner, investigate the reason for the error, and correct the report and the data source

- Implement a system of validation of data and error checking before the reports are sent

- Work on data quality

Accounting Payables: Number of Invoices per Employee

The accounting payables KPI measures the number of invoices that have not yet been paid by the company to its vendors or suppliers.

The number of invoices per employee is a metric that calculates the average number of invoices that each employee is responsible for processing and managing within a given period of time. So, this KPI can help finance professionals determine the efficiency of their accounts payable department and identify potential areas for improvement.

How to improve

- Standardize the process and eliminate exceptions

- Digitalize invoices

- Use OCR (Optical Character Recognition) and RPA (Robotic Process Automation) technology to let software read your invoices, recognize the information, match it with your accounting software encoding fields, and book it into your ERP or software tool

FP&A Limit Variance

The deviation of actuals vs budget is a KPI that measures the variance between actual financial performance and the budgeted performance for a given period.

The calculation of this KPI involves comparing the actual financial results with the budgeted amounts and then calculating the difference between them as a percentage or an absolute value.

A positive deviation indicates that the actual performance is better than the budgeted performance. While a negative deviation suggests that the actual performance is worse than the budgeted performance.

How to improve

- Use a journal of all errors you identify and take into account for the next budget

- Challenge the models you have used in the past / run your assumptions to your business partners to be closer to reality

- Use planning tools to automate your planning and enhance your collaboration

Cost of The Finance Function as A Percentage of Sales

The cost of the finance function as a percentage of sales is a KPI that compares the total cost of a company’s finance function (including salaries, overheads, and other expenses) to its total sales revenue, expressed as a percentage.

Moreover, this KPI helps finance professionals to understand the efficiency of the finance function. Also, whether its costs are in line with the company’s overall revenue. A high percentage may indicate that the finance function is consuming a significant portion of the company’s resources, which may be unsustainable in the long run.

On the other hand, a low percentage could suggest that the finance function is not adequately resourced. Then, if it is not adequately resourced it will impact the accuracy and reliability of financial reporting.

How to improve

- Review your management span and layers

- Centralize activities

- Use standardization and then automate processes

- Get rid of nice-to-have tasks and focus only on critical processes

- Leverage technology to reduce the manual work

Savings Identified

The savings identified KPI measures the amount of cost savings or cost avoidance opportunities that have been identified by a company’s finance or procurement team during a given period of time.

This is an important metric for assessing the effectiveness of cost management efforts within a company. It helps you identify areas where you can achieve cost savings, such as negotiating better supplier contracts, optimizing procurement processes, or reducing unnecessary expenses.

How to improve

- Implement a saving plan

- Give a task to everybody to find 50k savings

- Use benchmarks

- Discuss with business partners

- Review your SaaS costs

- Reduce consumption of energy

Project Controlling

Project controlling is a KPI that measures the effectiveness of a company’s project management process. It involves monitoring and controlling project activities to ensure that they are completed on time. Additionally, within budget, and to the desired quality standards.

The project controlling KPI typically involves tracking a range of metrics related to project management, including:

- Budget variance: The difference between the planned budget for a project and the actual budget spent.

- Schedule variance: The difference between the planned timeline for a project and the actual timeline achieved.

- Quality variance: The difference between the planned quality standards for a project and the actual quality achieved.

- Risk management: The effectiveness of the company’s risk management process in identifying, mitigating, and managing project risks.

Annual Satisfaction Survey

The Annual Satisfaction Survey KPI measures the level of satisfaction of employees, customers, or other stakeholders with a company’s products, services, or overall performance over a period of one year.

This KPI typically involves conducting a survey that asks respondents to rate various aspects of the company’s performance, such as customer service, product quality, or employee engagement.

Therefore, you can use the results from the survey to identify areas where the company is performing well and areas where you need to improve.

How to improve

- Take any negative point and investigate the root cause and add it to your objectives to solve it

Conduct Regular Performance Reviews

Conducting regular performance reviews is essential to assess the performance of finance teams. Also, these reviews should be objective, constructive, and focused on improving performance. In addition, the reviews should include feedback from team members, stakeholders, and senior management.

Ultimately, regular performance reviews can help identify areas of improvement, address any issues, and set new goals and objectives.

Develop A Professional Development Plan

A professional development plan can help finance teams improve their skills and capabilities, which can lead to better performance.

Furthermore, the plan should include training, coaching, and mentoring programs that align with the goals and objectives of the finance teams. You should also regularly review the plan and update it to ensure that it is effective.

Implement Best Practices

Finance teams should implement best practices that align with the company’s strategic priorities. However, these practices should include process improvements, automation, and standardization of financial processes.

Therefore, the best practices can help improve efficiency, reduce costs, and improve the accuracy of financial reporting.

Conclusion – Assessing The Performance of Finance Teams Will Bring Better Results

Assessing the performance of finance teams is essential for any company that wants to ensure its financial health and success.

However, to assess the performance of finance teams, it is crucial to establish clear goals and objectives, measure key performance indicators, conduct regular performance reviews, develop a professional development plan, and implement best practices.

By following these steps, finance teams can improve their overall performance, which can lead to better financial results for the company.

Finally, if you take my course, you advance your FP&A career to the next level and join a group of successful finance professionals!